Montgomery County Seniors and Veterans May See Property Tax Relief Under Bill 45-23

- Center for Local Policy Analysis (CLPA)

- Dec 12, 2023

- 2 min read

Montgomery County residents struggling with rising property taxes may find relief in the proposed Bill 45-23, Property Tax Credit – Individuals 65 and Above, Retired Military Service Members, and Disabled Military Service Members. This bill seeks to expand property tax eligibility and increase potential property tax credit amounts for residents 65 and above, who make up 17.2% of the County's population as of the last Census. The bill would also provide assistance for retired or disabled military service members and their spouses.

By reducing the residency requirement for seniors, offering tiered credit amounts based on income, and extending the credit duration, the bill aims to provide significant financial assistance to the county's older adults. Additionally, the inclusion of disabled veterans and their surviving spouses in this bill recognizes their service and sacrifices.

Let's briefly dive deeper into the specifics of Bill 45-23, exploring its potential benefits, drawbacks, and political implications.

Eligibility

1. Individuals 65 and Above:

Eligibility: Reduced the residency requirement from 40 years to 25 years.

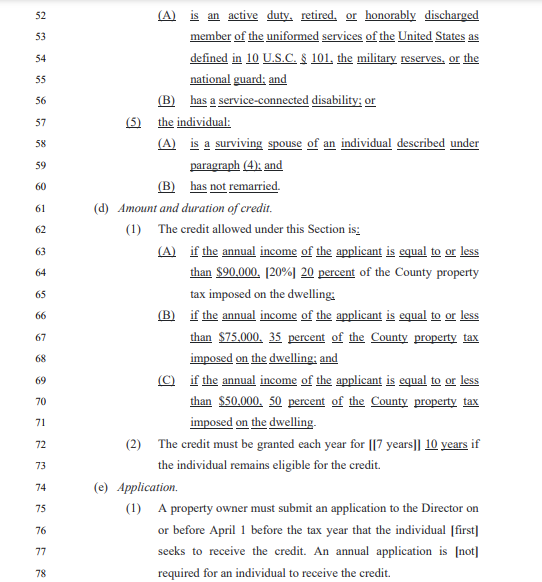

Credit Amount: Tiered the credit based on income: 20% for incomes under $90,000, 35% for incomes under $75,000, and 50% for incomes under $50,000.

Duration: Increased the duration of the credit from 7 years to 10 years.

2. Retired and Disabled Military Service Members:

Eligibility:

Expanded eligibility to include surviving spouses of deceased disabled veterans.

Increased the maximum assessed value of eligible homes to $899,999 (adjusted annually for inflation).

Credit Amount: Same tiered system as individuals 65 and above.

Duration: Same 10-year duration as individuals 65 and above.

Potential Benefits and Limitations

The bill is likely to face support from several groups:

Seniors: The bill's provisions for seniors, such as reduced residency requirements and tiered credit amounts, could benefit low-income seniors of color who are disproportionately burdened by high property taxes. This could help them remain in their homes and communities.

Military Families: The inclusion of disabled veterans and their families, a significant portion of whom may be racial and ethnic minorities, could provide much-needed financial assistance and support. This could be particularly beneficial for families living in areas with high housing costs.

However, there may also be some opposition who have concerns regarding:

Eligibility Criteria: The bill's eligibility criteria, including age and income limits, may inadvertently exclude some low-income individuals and families of color who may not meet the specific requirements

Geographic Distribution: The benefits of the bill may not be evenly distributed across the county, potentially favoring certain neighborhoods or communities with higher concentrations of eligible residents. This could exacerbate existing disparities in wealth and access to resources.

Funding Concerns: A lack of a clear funding mechanism for the bill raises concerns about potential cuts to other essential services that may disproportionately impact low-income communities and communities of color.

Bill 45-23 was introduced at today's Montgomery County Council meeting. Whether it passes and in what form remains to be seen, but it will likely generate significant discussion and debate. If you have any concerns about the bill, contact the lead sponsor, Council President Friedson.

Text of Bill 45-23, Property Tax Credit – Individuals 65 and Above, Retired Military Service Members, and Disabled Military Service Members:

Comments